How Federated Funding Partners can Save You Time, Stress, and Money.

Table of ContentsThe Only Guide to Federated Funding PartnersThings about Federated Funding PartnersUnknown Facts About Federated Funding PartnersWhat Does Federated Funding Partners Do?What Does Federated Funding Partners Do?

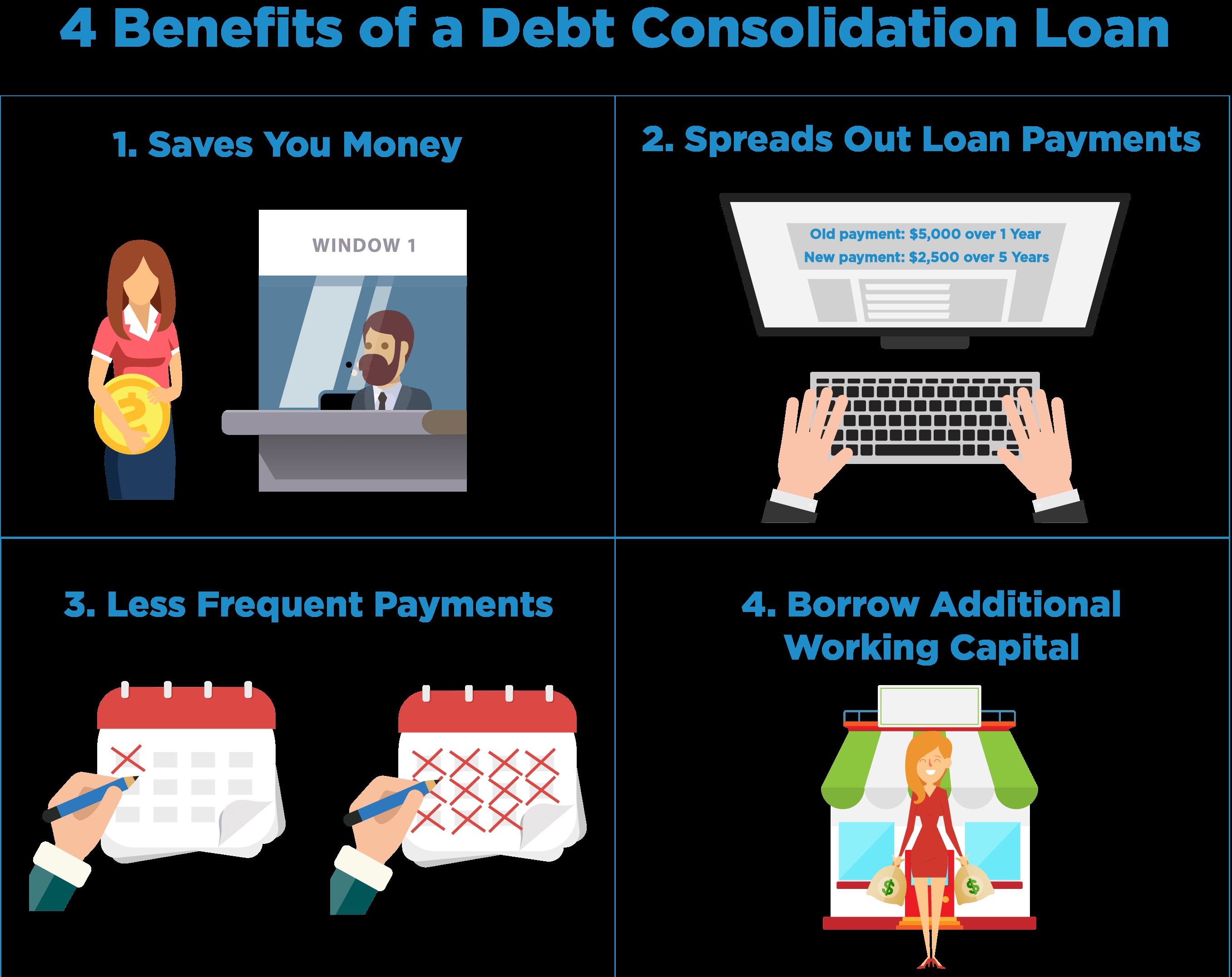

Right here's what you require to understand about financial debt loan consolidation: What are the advantages of debt combination? Conserving on interest repayments. The primary advantage of financial debt combination is conserving on passion costs. Long-term debt with a high rate of interest rate can cost countless bucks in rate of interest settlements over the life of the funding.

With just one monthly repayment to make, handling your financial debt will be a whole lot easier. Debt consolidation frequently means having a set settlement timeline.

If you have actually been falling behind on your regular monthly repayments, moving your several financial debts to a single low-interest finance can assist to increase your rating. What are the disadvantages of financial debt consolidation? May extend the settlement timeline of the financial obligation. Moving financial debt to a brand-new funding can often include extending the term of the loan.

Doesn't remove irresponsible costs routines. If spending too much as well as untrustworthy money administration is what landed the consumer in the red to begin with, settling debt on its very own will certainly not address the issue. Lower interest price may not last. Numerous low- or no-interest bank card only offer these features as a momentary promotion.

Federated Funding Partners Things To Know Before You Buy

Just how can I combine my financial obligation? You have a number of choices for financial obligation combination, each with its very own benefits and drawbacks. Personal Funding or Line Of Credit (PLOC): Taking out an unsafe car loan from Abilene Teachers FCU will enable you to pay off all your exceptional car loans quickly and move your financial debts into one low-interest financing.

Additionally, given that they're unsafe, the rates of interest on these car loans can be high. Lucky for you, however, as a member of Abilene Educators FCU you have accessibility to personal car loans or credit lines with no source fees and interest prices as low as 7. 75% APR *. Look into all our options! Home Equity Loan (HEL): A residence equity car loan uses your house as security for a fixed-term finance.

Also, if the value of your residence decreases, you may finish up owing more on your house than what it deserves. Lastly, repayment terms for HELs can be up of one decade. As secured debt, interest on HELs will certainly be inexpensive as well as might provide you with significant financial savings. Interest on house equity lending products is often tax-deductible also.

You could just wish to consolidate your different credit lines. Instead of trying to grasp all those numbers in your head or producing an impressive spread sheet, you might just wish to consolidate your different lines of credit history. Financial obligation combination is when you integrate existing financial debts right into a new, single lending.

Indicators on Federated Funding Partners You Should Know

What Is Financial debt Debt consolidation? It's when you take out one lending or line of credit scores as well as utilize it to pay off your different debtswhether that's pupil lendings, cars and truck loans, or credit card financial obligation.

Debt alleviation programs can help you combine your financial debt, yet they aren't getting you a brand-new loanit's only debt consolidation. While you have the ability to consolidate various kinds of loans, the process for consolidating trainee loans is various. Maintain checking out to comprehend just how they are various. Looking for a Debt Consolidation Finance When picking a financial debt loan consolidation loan, try to find one that has an interest price and also terms that match your total monetary photo.

As soon as you use as well as are approved for a financial debt loan consolidation financing, it might take anywhere from a few days to a week to get your money. Sometimes the lending institutions will a fantastic read pay your debts off directly, other times they will certainly send you the car loan money, and also you'll pay the financial obligations off yourself.

Financial obligation combination finances have a tendency ahead with lower rate of interest than charge card. A debt combination funding may be a choice to think about if your monthly settlements are feeling method too high. When you get a brand-new funding, you can extend the term length to decrease just how much you pay each month.

An Unbiased View of Federated Funding Partners

With protected lendings, you utilize a property like a home or cars and truck to assure the finance. If something takes place and also you can not settle the car loan, then the bank can take the possession that is serving as collateral. federated funding partners. An unprotected financial obligation consolidation car loan can assist you prevent putting other possessions on the line.

Normally, individuals seeking financial obligation combination financings have numerous resources of financial debt as well as intend to achieve two things: First, reduced their passion rateand therefore pay much less each monthand decrease the amount they need to pay over the life of their lending (federated funding partners). Second, they are trying to combine numerous finances into one, their website making it less complicated to keep track of regular monthly repayments.

Another option is to decide for a shorter repayment term, which reduces the repayment period and also to help obtain the consumer out of financial obligation faster. For instance, say a consumer has $10,000 on a credit scores card, paying 20% in rate of interest, and also the minimal repayment is 4%. If they pay the minimal declaration balance each month, it would certainly take 171 months, or 14 years as well as three months, to pay it back.

7 Simple Techniques For Federated Funding Partners

If you combine that financial debt with a new funding that has an 8% passion price and also a 10-year term, you will certainly pay $4,559. Not only would you save cash in passion by consolidating your debt card financial obligation, yet you can possibly boost your credit rating rating by paying back your combined lending on time.